For most people, anniversaries are occasions to celebrate. Just like it is for Vijay Shekhar Sharma, founder and chief executive officer (CEO) of One97 Communications, Paytm’s parent company, today. The digital payments firm celebrated the first anniversary of its initial public offering (IPO) made last year, and it has some reasons to cheer.

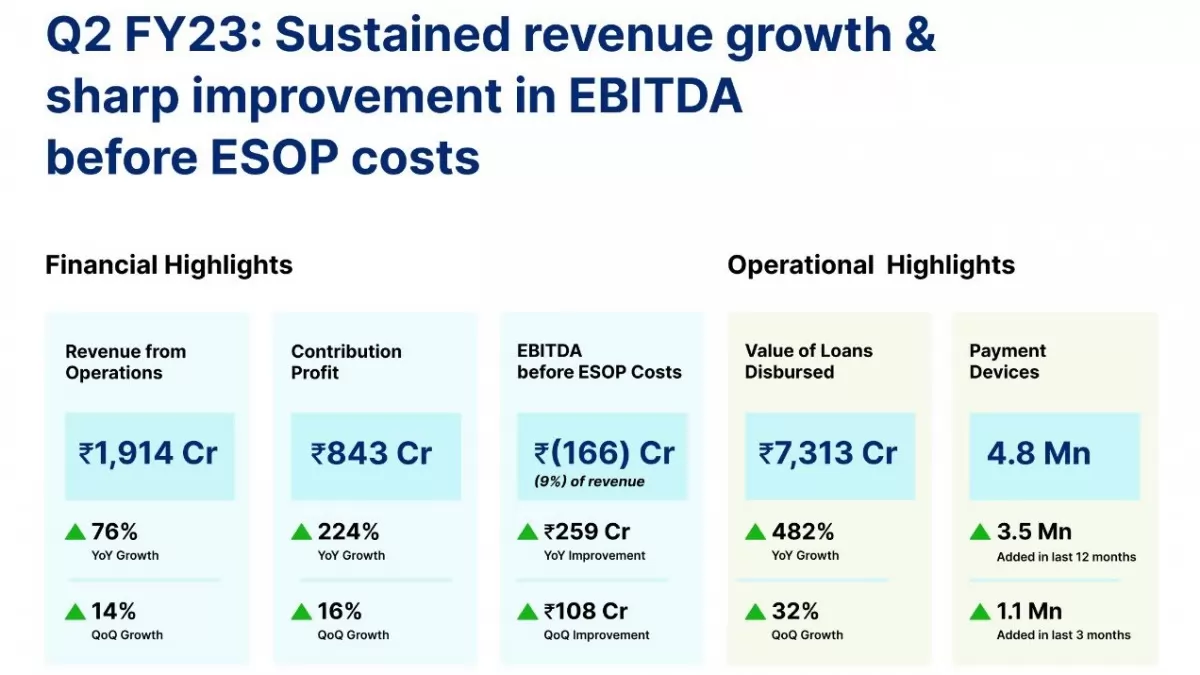

Its revenue from operations in September 2022 (Q2 FY2023) stood at Rs 1,914 crore, which is a 76 per cent year-on-year (YoY) growth. Paytm claimed this was driven by an increase in merchant subscription revenues, growth in bill payments due to growing monthly transacting users (MTU) and growth in disbursements of loans through the platform.

“Payments services revenue grew 56 per cent YoY and our net payment margin grew by over 400per cent on back of platform expansion,” the company’s filings with the stock exchange stated. “Revenue in Payment Services to Consumers business was Rs 549 crore, increasing 55 per cent YoY, while that in Payment Services to Merchants was Rs 624 crore, increasing 56 per cent YoY.”

These figures must have come as a relief to Sharma, who faced a trial by fire this August when shareholders had to decide whether they wanted the billionaire founder to continue holding the company’s reins following its disastrous IPO debut.

So, why did India’s poster child for the fintech community paint a sorry picture at the bourses last November?

Big Bang That Fizzled Out

Paytm’s IPO debut on November 8, 2021 at Rs 18,300 crore was touted as one of the biggest among India’s tech-first brands. It had priced its shares in a price band of Rs 2,080 to 2,150 per share, valuing the company at Rs 1.39 lakh crore at the upper end of this band.

However, it was listed on the bourses at a 9 per cent discount to its offer price and the share touched the lower circuit on its market debut day. Outlook Business reported that it closed for Rs 1,560, 27.40 per cent below the offer price. Out of the entire issue, the fresh issue was worth Rs 8,300 crore and the offer for sale was for Rs 10,000 crore.

Several reasons were attributed to this dismal performance. In its research report, Too Many Fingers In Too Many Pies, Macquarie Capital claimed that Paytm's business model lacked focus and direction, calling the fintech “a cash guzzler”.

The Australian financial services company felt Paytm had spread itself too thin by having 15 domestic and 17 international subsidiaries under its aegis. Moreover, it planned to seek a new general insurance licence, which is still in the works, wherein it would hold a 74 per cent majority shareholding upfront.

Paytm Insuretech had entered into a share purchase agreement to acquire 100 per cent of Raheja QBE General Insurance Company Limited. However, this deal was later called off mutually by the two entities.

Voicing doubts about its scalability and profitability, the Macquarie Capital report added, “Paytm has been a cash-burning machine, spinning off several business lines with no visibility on achieving profitability. Paytm has drawn in the equity capital of Rs 190 billion since inception, of which 70 per cent (Rs 132 billion) has gone towards funding losses. The business generates very low revenues for every dollar invested or spent towards marketing. This is especially problematic for a low-margin consumer-facing business where competition across each vertical is only increasing.”

Motiwal Oswal also noted that Paytm’s “valuations were stretched far beyond limits”. It added that the fintech’s shares did a huge tumble “when shares went down by 58 per cent after the company got listed. From an initial valuation of $20 billion, it has come down to a paltry $7.8 billion. Now, the company is ardently trying to convince investors about its solid growth path, anxiously hoping to win back some capital.”

On Shaky Ground, But Standing Strong

While the scenario may look tough, the Q2 FY23 numbers show that Paytm still has a fighting spirit that seems to be a resonance of its 45-year-old founder’s never-say-die attitude.

A week before the company’s 22nd annual general meeting (AGM) this August, three proxy advisory firms—Investor Advisory Services India (IiAS), Stakeholders Empowerment Services (SES) and InGovern Research Services—advised shareholders to replace Shekhar as CEO. Among them, they cited concerns about his capability to reverse losses.

They also pointed out how the once-shining fintech had lost more than 60 per cent of its value since its IPO, while struggling to convince investors of its earnings potential.

IiAS noted, “Vijay Shekhar Sharma has made several commitments in the past to make the company profitable. However, these have not played out.”

However, Shekhar has stood steadfastly firm on his pledge to shift the company from “growth toward profitability”. At the recent AGM, he announced, “We are committed to building long-term profit. My ESOP grant is not vested until Paytm market cap has crossed the IPO price,” adding that the company was on track to becoming operationally profitable by September 2023.

His words must have hit home because 99.67 per cent of the company's shareholders voted in his favour and he was reappointed as the managing director and CEO.

Now, Shekhar has fixed his sights on profitability. In an interview with Bloomberg in July 2022, he claimed that the company “is in the business of payments, and it sells loans”, which accentuates his plans to focus on this segment to shore up profits.

In the Q2 FY23 quarter, Paytm disbursed Rs 7,313 crore loans, a 482 per cent YoY growth. The company’s regulatory filings stated, “Loan distribution business has scaled up significantly over the last 12 months, seeing increased adoption by users. Number of loans at 9.2 million, up 224 per cent YoY.”

Now that profitability is in Shekhar’s crosshairs, will it translate into a rise in the financial services company’s share prices? Will these encouraging profit figures help investors get a bang for their buck?