Travel portals actually help hotels increase their direct sales as most people come to the OTAs for their travel queries – unlike what’s perceived, these portals are a friend of the hospitality sector, not a foe, Pitti tells Outlook Business

It took online travel agency (OTA) EaseMyTrip a good 13 years to join the coveted unicorn club last September. The long wait, however, was courtesy being completely bootstrapped with a close eye on profitability. Its CEO and co-founder, Nishant Pitti, now wants to put the company in a fast-forward mode with a special focus on acquisitions to expand its service, especially in the non-air segment. With a strong global presence in the Philippines, Thailand, the United States, the United Arab Emirates, the UK, Singapore and New Zealand through wholly owned subsidiaries, the company is now planning for international take-overs in FY2022-23.

Edited excerpts:

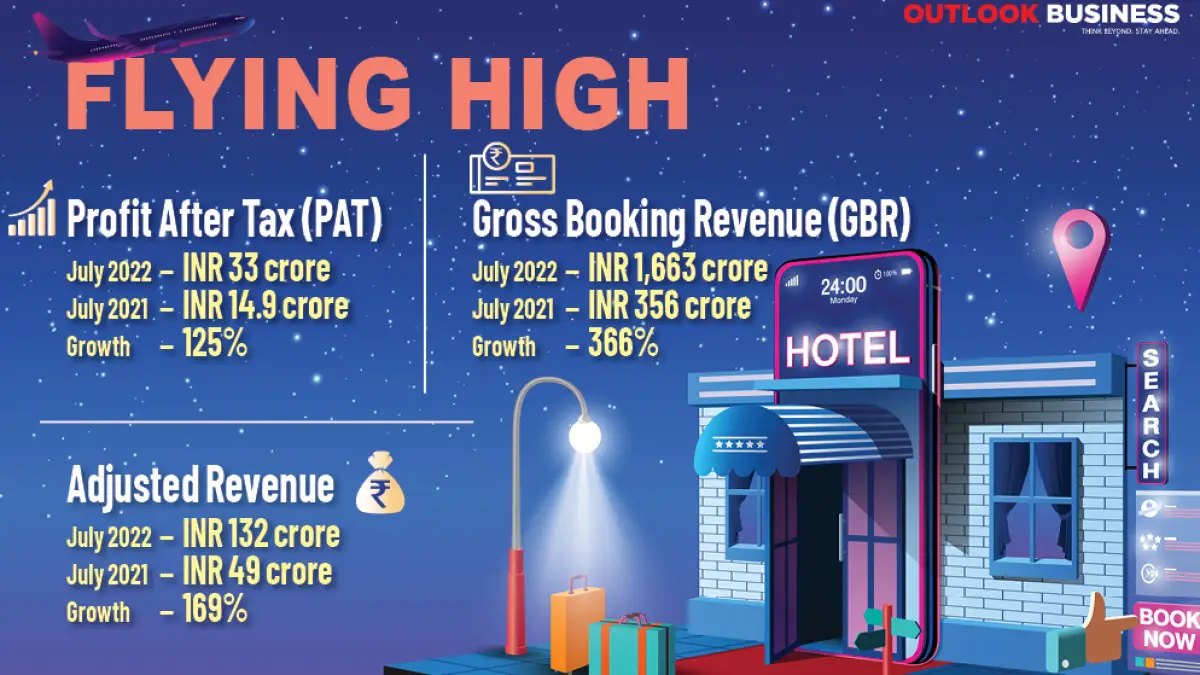

What factors led to EaseMyTrip’s whopping 125 per cent y-o-y rise in Profit after Tax (PAT) for Q1FY23 at INR 33.7 crore, up from INR 14.9 crore in the same period last fiscal?

Since its inception, EaseMyTrip’s core selling focus has been zero convenience fees. Despite this, we have been able to be profitable every year. We pioneered a lean cost structure in the low-margin travel market and continually retained profitability due to our adaptability and flexibility to disruptions.

Our key objective for FY2022-23 is to continue expanding within the sector of airline ticketing by increasing our profitability and market share. We will also expand our services to other non-air segments, such as hotels, buses, trains and holidays.

Additionally, we would make a concerted effort to cross-sell to our current clientele via new growth opportunities in the hotel and tourism sectors. Plans are also in the works to do business in other countries via subsidiaries and to use a 360-degree marketing approach to get customers and generate income.

What is your strategy to explore revenue from non-air segments?

EaseMyTrip is gradually expanding to become a complete travel ecosystem. If you see our recent acquisitions, YoloBus, Spree Hospitality and Traviate Online, most of them are in the non-air segment. As we advance, we will be heavy on acquisitions.

We are looking to expand in the hotel, holiday, taxi, and other segments and may make some international acquisitions in FY23. Simultaneously, we are also looking at enhancing our brand image and expanding our territorial tentacles globally.

We have grown our global presence by establishing wholly owned subsidiaries in the Philippines, Thailand, the United States, the United Arab Emirates, the UK, Singapore and New Zealand. As we expand into new areas, we expect a significant increase in travel and tourist industry demand in the coming months.

In FY 2022-23, EaseMyTrip will also expand its services to non-air segments, such as hotels, buses, trains and holidays

Your Q1FY22 Gross Booking Revenue (GBR) increased by 366 per cent, from INR 356.7 crore to INR 1,663.1 crore last year. However, with monkeypox and COVID fears gaining ground, can EaseMyTrip maintain this pace?

Yes, we are confident about achieving sustainable growth. Due to the knowledge we gained in the travel sector, we have been able to navigate the worldwide market relatively easily.

While the pandemic impacted the travel and tourism industry, we could weather the storm by bolstering our strategy. This included improved commissions, enhanced operational efficiency, and measures to reduce costs.

We were clear from the beginning that we wanted to attract customers via our value-driven services rather than our marketing efforts since we have always prioritised passing its value on to the customers rather than spending money on marketing and operations. Consequently, this move assisted us in boosting our business.

Alleging that OTAs charge a hefty commission, which cuts down their profit margin, hoteliers are investing in direct sales channels and loyalty programmes. How will this affect the future of hotel distribution?

OTAs and hotels are mutually dependent. Customers invariably tend to look for a hotel, its rating and reviews on an OTA platform first and then search for direct websites to learn more about it. Although OTAs want to promote bookings through their sites to earn a commission, they still indirectly help hotels increase direct bookings. Ultimately, OTAs are more of a friend than a foe because they can help a hotel increase bookings.

Inflation, rising energy costs, market volatility and the lingering Ukraine war, are impacting the hospitality industry. How is EaseMyTrip helping hoteliers manage their profit margin without putting up rates and increasing Revenue Per Average Room (RevPar)?

These external factors have caused costs to go up. In hotels, the prices have marginally increased by 25 to 30 percent, which has shrunken margins. As an OTA, we are helping hoteliers in various ways to increase the RevPar like reducing commission slab, marketing, approaching the right customer, etc.

With the length of stay reducing, how are hotels maximising their profits?

Hotel prices have risen considerably. Recognising travel trends and the length of stay, some hotels offer packages or extended residences and service apartment facilities with all amenities. Fine dining, coffee shops, and in-room dining are significant revenue generators.

Domestic travellers remain a crucial business sub-segment. Within this, couples, extended families, young pet parents and other groups have distinct needs, and hotels are adapting to meet them to maximise their profits.

What are some imminent travel trends for this year?

There were fears that the pandemic might hamper and alter the travel and tourism industry, amongst many. However, after the respite from the pandemic, there has been a new zeal within the travel industry and it is contagious.

Many people want to travel, and the sentiment is at an all-time high. We are looking at the golden era for our industry. People are opting to utilise long weekends as weekend getaways for relaxing and having fun with their loved ones. Currently, the top locations where EaseMyTrip is experiencing strong bookings include Goa, Rajasthan, Himachal Pradesh, Coorg, and Kerala. Popular international destinations are Maldives, Bali, Singapore, Thailand, Dubai, Europe and the UK.

How will the decision to introduce a co-branded credit card and debit card with Standard Chartered Bank help EaseMyTrip gain or retain customers?

At EaseMyTrip, our emphasis is to build a travel ecosystem where customers are always at the benefiting end. While we do so, our focus remains on exploring partnerships that interest our customers and attract them towards multi-promotional offers allowing them to have experiential travel with us. We are confident that this card will prove to be the favourite accessory for customers.

Surge 07 comprises 37 founders across 15 start-ups leveraging technology and consumer insights to drive innovation

This marks the fintech unicorn's fifth acquisition in the past four years as it attempts to establish an omnichannel presence