When Flipkart launched Flipkart Quick—its 90-minute grocery delivery service in July 2020—it seemed to be a smart move by the Walmart-backed unicorn since quick commerce was the up and rising sector. The pandemic-induced lockdown saw many consumers take to quick commerce happily, placing the sector’s estimated addressable market size to approximately $49 billion, as per Statista.

In February 2022, Flipkart Quick reduced the delivery time frame to 45 minutes for few areas in Bangalore in a bid to crack the already overheated segment.

Cut to November 2022, the ecommerce major has scaled down Flipkart Quick consolidating the business with its next-day grocery delivery platform Flipkart Supermart. This effectively means that its quick commerce service, which was available in 14 Indian cities, including Delhi, Hyderabad, Ahmedabad, Kolkata, Bengaluru, and Chennai, is currently operational in only two cities.

Flipkart Quick is not the only quick commerce entity to bite the slowdown bullet.

In August 2022, Reliance-backed delivery app Dunzo, ventured into the online grocery space by launching Dunzo Daily—its 19-minute delivery service—in Bangalore. It had ambitious plans to expand to 20 cities and is currently operational in seven of them.

A $240 million cash infusion by Reliance this January gave the Bengaluru-based start-up enough headroom to invest in inventory and burn cash to acquire customers. However, recent reports of Dunzo shutting down a good number of its dark stores, which are warehouses that store inventory, across NCR and Hyderabad indicate that things are not going as per plan for the company.

Yet another tech-enabled company that decided to join the quick commerce bandwagon was Ola. In December 2021, it started Ola Dash as a 10-minute grocery delivery service in Bengaluru with plans to launch a network of 500 dark stores across 20 cities.

In April 2022, Ola scaled down its business and temporarily suspended operations of most of its dark stores following declining demand. Ola Dash’s expansion plans were put in the deep freeze due to growing hyper-competitiveness in the quick commerce space.

In short, speed thrills, but also kills; business plans that is. And the above instances prove that quick commerce is not everyone’s cup of tea.

The segment, however, remains a promising one. According to a report by consulting firm Redseer, India's quick commerce sector is expected to grow 10 to 15 times in the next five years to become a $5 billion market by 2025.

However, there is an unwritten caveat. The ones who will survive and even thrive will be players with solid financial backing and strong business fundamentals who can sustain the pressure of ultra-quick deliveries.

For now, only two contenders, Blinkit and Zepto, (and to some extent Swiggy Instamart) have been able to hold their own in this dynamic space, creating an unintentional duopoly of sorts.

Zip, Zap, Zoom: The Name Of The Game

Six months after its inception in September 2020, Mumbai-based Zepto raised $160 million, doubling its valuation to $570 million. This impressive start gained even more attention since its founders were two 19-year-old Stanford scholars Aadit Palicha and Kaivalya Vohra.

The duo had started KiranaKart, delivering groceries under 45 minutes, crunching it to 15 minutes for customers who lived close to pick-up points. They decided to finetune this idea to delivery groceries under 10 minutes and thus Zepto was born.

The company has managed to crack the 10-minute delivery model by achieving a median time of roughly eight minutes and 47 seconds for completing deliveries. It did this by drilling down the average delivery distance from the pick-up point to the drop location and keeping deliveries within a 2-kilometer radius.

According to Zepto’s chief executive officer and co-founder Palicha, quick commerce is a complex business with many moving parts. He maintains that the reason the start-up, which is operational in 10 cities, was able to outgrow other legacy brands was because it focused a lot on execution.

“If we continue to execute better, we will win. If not, we will lose. It’s all about how smart is your customer execution, what’s your capital efficiency, how you are able to squeeze growth month on month without breaking the back. Pure play execution is everybody’s advantage and everybody’s disadvantage,” Palicha claims.

Blinkit, earlier Grofers, is the other strong player in the quick commerce space. While Gurgaon-based Grofers was founded in 2013, it rebranded itself to Blinkit in December 2021 as a 10-minute delivery service. It was later acquired by Zomato for Rs 4,447 crore ($569 million) in an all-stock deal, was part of the latter’s strategy to tap the online grocery retail segment, which saw unprecedented growth during the pandemic.

Currently operational in 20 cities, Blinkit, too, has been able to maintain its 10-minute delivery track record even in Tier II cities and is hopeful of acquiring more customers in the future.

“We believe that quick commerce is still in its very early stages, with a lot of room for everyone to grow. Our strategy has been to ensure that we provide consistent service to our customers when they need us. We are continuously expanding more use cases which are relevant in this space,” said the Blinkit spokesperson to Outlook Business.

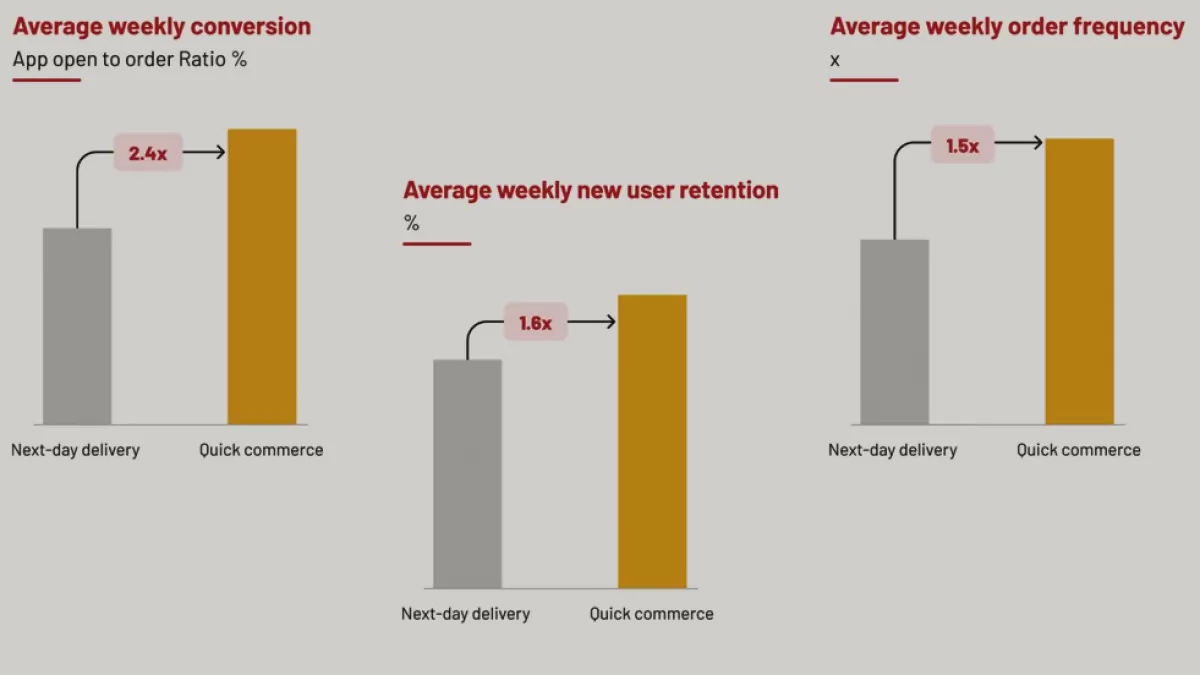

Blinkit also believes that customers have shown a clear preference towards instant delivery, compared to next-day delivery according to its customer facing metrics.

The Right Backing Matters

While Mumbai continues to be Zepto’s stronghold, the start-up now plans to penetrate deeper into the cities where it is already operational by building a wider product assortment. Fortunately, it doesn’t have to worry about cash after having raised $200 million in a Series D funding round in May 2022 at a valuation of $900 million.

This may help it hold its stead as a standalone quick commerce player where similar companies have failed. This failure can be traced to the lack of financial wherewithal to in invest in customer acquisition, set up a supply chain complete with dark stores as well as a well-outlined inventory model.

The availability of capital can be a dealbreaker when it comes to oscillating between success or failure in a high cash burning sector like quick commerce. This is where players with an existing infrastructure and strong backing have been able to fight it out as their parent company’s continues to pump in money into the venture.

For instance, Blinkit is backed by Zomato, Swiggy Instamart by Swiggy and BB Now by Tata-owned BigBasket. The support of bigger entities can help the fledging brands score better in key metrics, be it customer acquisition, having the right inventory or right stocking point.

Most players backed by established names are also repurposing stocking points and partnering with some of the marketplaces and neighbourhood stores – which Blinkit has been doing -- who are extending into quick commerce for mutual benefit. This also helps them collaborate better to nudge customer spending behaviour.

“It all boils down to how you are able to change consumer habits – which is happening quite well in India in comparison to the US and Europe,” says Angshuman Bhattacharya, Partner at EY Parthenon-Strategy and Transactions, Leader for Consumer Products and Retail at EY India. “If you have a bigger player backing you, it becomes an omnichannel play. So, there will a consolidation towards players who already have a marketplace or a foodtech platform and customer data.”

Survival Of The Fittest And Fastest

Some major challenges in the quick commerce sector include the low play of margins, in the range of 18 per cent to 20 per cent, lack of manpower and inventory management.

For example, Dunzo, which was a delivery app before, found it difficult to make profits because it was just a manpower service that pivoted into quick commerce. It soon realised that mapping delivery and pickup is a completely different ballgame than managing inventory in dark stores while also adhering to 10-minute delivery timelines.

According to Bhattacharya, the only way forward for these companies to sustain is by taking inventory just like an omnichannel retailer would since it then gives them better product margins. “Also, if at all quick commerce has to make money, it will be through a model wherein they make margins from the inventory and also from the brands of products,” he adds.

Experts predict that the proliferation of more players in local catchments and local markets. However, the sector will see mass consolidation with buyouts of regional players by larger brands. This is largely because of the significant bandwidth required for building hyper-local supply chains, which smaller players would find challenging.

“Another four to five years from now, it will be a model of connected commerce and multiple ways of serving a customer and a pin code. We must think of all this keeping either the customer or the pin code at the centre,” Bhattacharya opines.

While the quick commerce segment remains a play of geographies, it remains to be seen if apart from Blinkit and Zepto, which other players are able to scale operations on a pan-India level, just like food delivery apps have managed to. Or will the future see some new permutations emerging in the already heated up space?